West Red Lake Gold Commences 3,000 Metre Drill Program at Fork Deposit

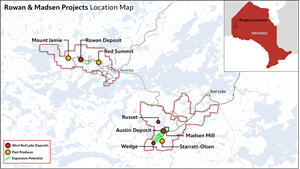

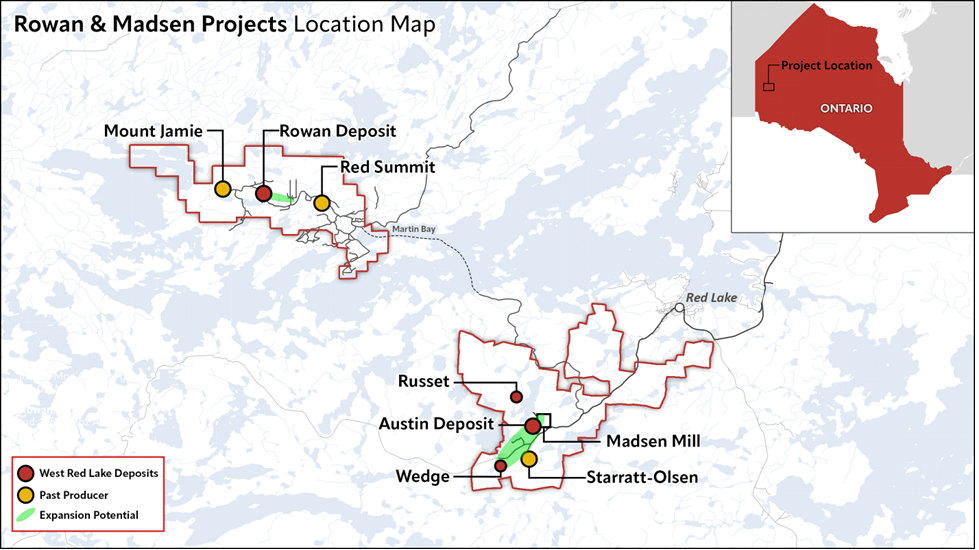

VANCOUVER, British Columbia, Nov. 26, 2025 (GLOBE NEWSWIRE) -- West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or “WRLG” or the “Company”) (TSXV: WRLG) (OTCQB: WRLGF) is pleased to announce a fully funded infill drilling program at its 100% owned Fork Deposit located approximately 250 metres (“m”) southwest from its Madsen Mine in the Red Lake Gold District of Northwestern Ontario, Canada.

“Once considered a somewhat diffuse, intermediate-grade portion of the satellite resource inventory at Madsen, the core of Fork has been re-envisioned as a high-grade near-mine resource expansion target that is a priority for immediate advancement,” stated Shane Williams, President and CEO. “The shallow nature of the deposit will allow for efficient definition drilling from surface and, with its high grades and proximity to existing underground development, it is easy to envision this core zone of Fork becoming part of the production pipeline at Madsen, based on successful infill drilling results.”

“The Madsen Mine shows clear potential to become a sizeable and long-lived operation, with several satellite deposits not yet considered in the mine plan, multiple untested exploration targets, and a 1.5-million-ounce indicated resource1 that is wide open for expansion at depth. Fork is the first opportunity we are advancing to make good on that potential. As an unmined and near-surface deposit sitting just 250 metres from Madsen, Fork offers a non-remnant zone of mineralization that could be accessed within a few months of development and sequenced into the mine plan with ease, providing additional optionality and ounces in the near term. With Madsen nearing commercial production in Q1 of 2026 we are ready to actively pursue a hub-and-spoke growth model at Madsen. Simultaneous surface drilling programs at Fork and Rowan take us in that direction and we will continue to evaluate and develop additional high-grade gold opportunities within the Red Lake district.”

OVERVIEW:

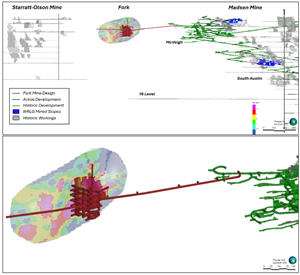

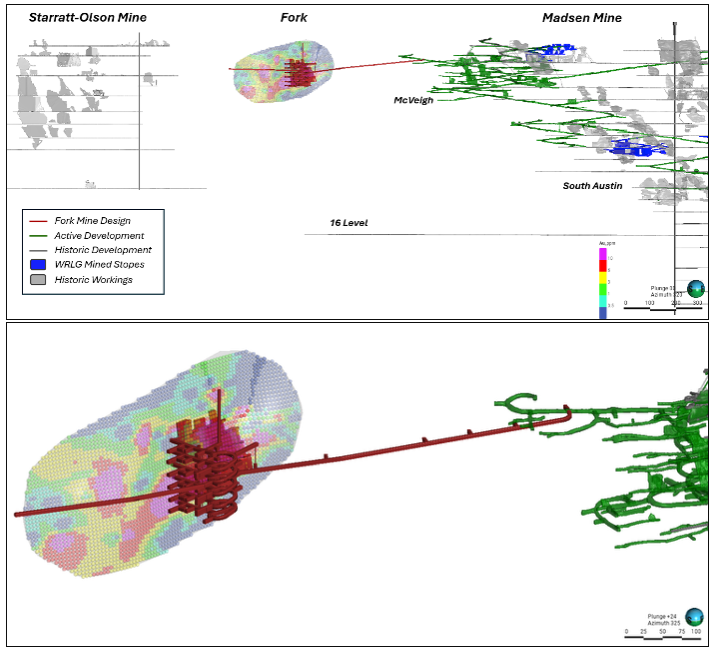

- The drill program at Fork will consist of approximately 3,000 m of NQ diameter diamond drilling from surface to inform a construction decision on bringing this adjacent resource area into consideration for near-term production at Madsen (initial mine design concept is illustrated in Figure 1).

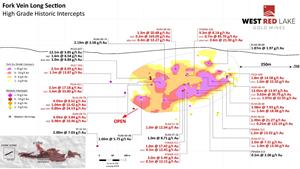

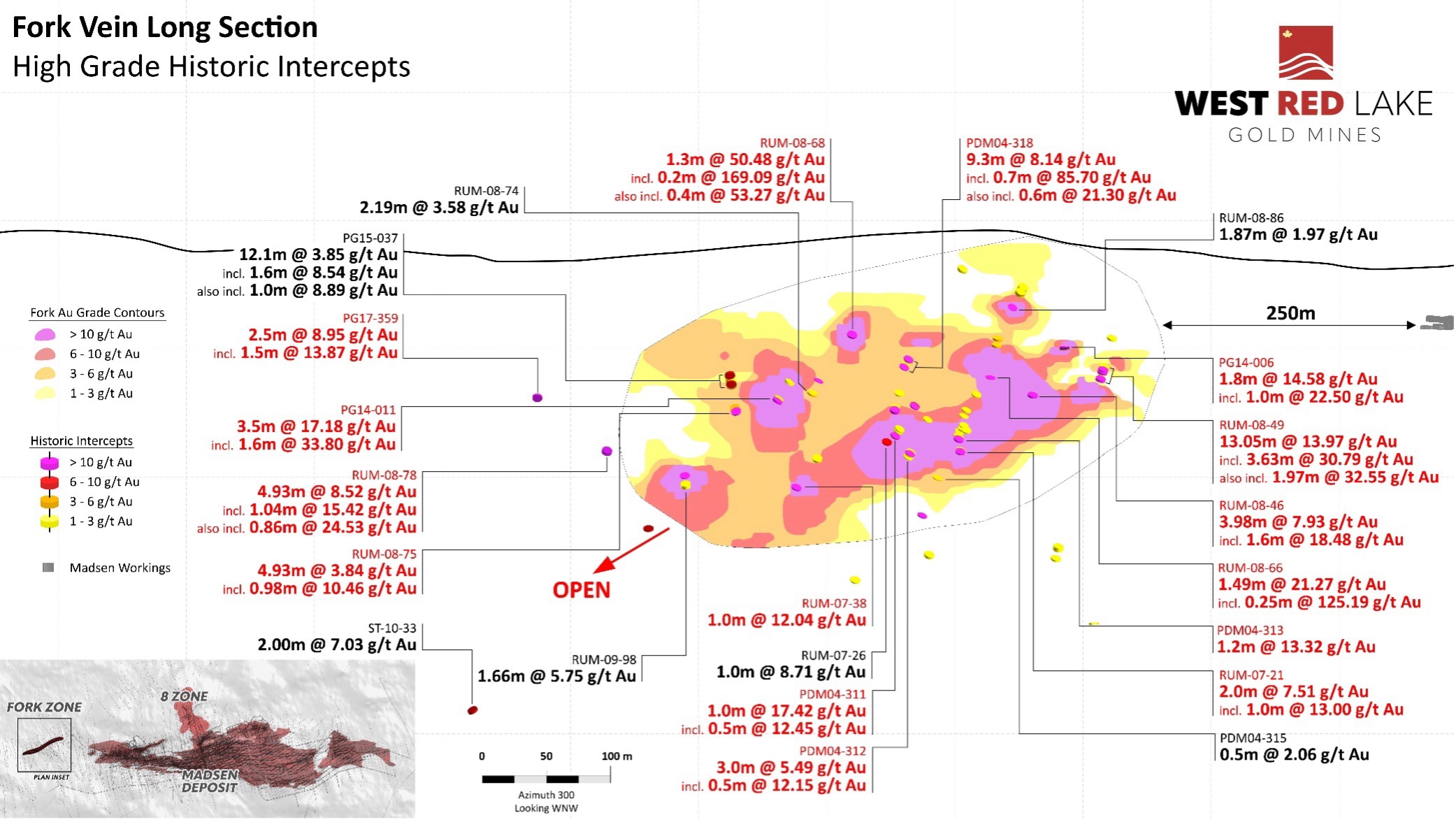

- Infill drilling will be focused on a shallow, high-grade, low-plunging zone of gold mineralization that was recognized during a re-evaluation of the Fork deposit by WRLG in 2024 (Figure 2).

- The zone trends north-south and has been defined by previous drilling over an area of 400 m by 250 m and shows potential for further expansion down plunge to the south. Average thickness of the zone is conservatively estimated at approximately 2 m based on existing core length intercepts.

- The shallow nature of this target will allow for systematic and efficient infill and expansion drilling from surface with holes averaging 170 m depth.

- The extension of underground development towards Fork will also open significant exploration potential and underground drilling opportunities along the main structural trend from Madsen towards the past-producing Starratt-Olson Mine which historically produced ~164,000 ounces of gold between 1948-1956.

The Fork deposit currently contains an Indicated mineral resource of 20,900 ounces (“oz”) grading 5.3 grams per tonne (“g/t”) gold (“Au”), with an additional Inferred resource of 49,500 oz grading 5.2 g/t Au. West Red Lake Gold announced the interpretation of a high-grade core within this resource in the Company’s December 10, 2024 news release (news release available here).

FORK DRILLING HIGHLIGHTS (HISTORIC):

-

Hole RUM-08-49 Intersected 13.05m @ 13.97 g/t Au, from 107.65m to 120.7m, including 3.63m @ 30.79 g/t Au, from 110.37m to 114.00m. Also including 1.97m @ 32.55 g/t Au, from 118.73m to 120.70m.

-

Hole PDM04-318 Intersected 9.3m @ 8.14 g/t Au, from 128.1m to 137.4m, including 0.7m @ 85.70 g/t Au, from 128.1m to 128.8m. Also including 0.6m @ 21.3 g/t Au, from 136.8m to 137.4m.

-

Hole RUM-08-68 Intersected 1.3m @ 50.48 g/t Au, from 95.7m to 97.0m, including 0.2m @ 169.09 g/t Au, from 95.8m to 96.0m. Also including 0.4m @ 53.27 g/t Au, from 96.2m to 96.6m.

- Hole PG14-011 Intersected 3.5m @ 17.18 g/t Au. from 152.5m to 156.0m, including 1.6m @ 33.80 g/t Au, from 154.4m to 156.0m.

FIGURE 1. Conceptual Fork deposit mine design, shown relative to the Madsen Mine and past-producing Starratt-Olson Mine (above) and close up (below), with access driven from Level 3 of the McVeigh area of the Madsen Mine. Note these are provided to illustrate the proximity of the Fork deposit to the Madsen Mine and the initial mine design concept; Fork is not part of the Madsen Mine Pre-Feasibility Study (“PFS”) and mining at Fork has not been proven economic according to a Preliminary Economic Assessment, PFS, or Feasibility Study.

TABLE 1. Significant intercepts (>1 g/t Au) from historic drilling at Fork Target.

| Hole ID | Target | From (m) | To (m) | Length (m)* | Au (g/t) |

| PDM04-311 | Fork |

209.50 | 210.50 | 1.00 | 17.42 |

| Incl. | 209.50 | 210.00 | 0.50 | 12.45 | |

| PDM04-312 | Fork |

213.00 | 216.00 | 3.00 | 5.49 |

| Incl. | 214.50 | 215.00 | 0.50 | 12.15 | |

| PDM04-313 | Fork | 196.90 | 198.10 | 1.20 | 13.32 |

| PDM04-315 | Fork | 221.30 | 221.80 | 0.50 | 2.06 |

| PDM04-318 | Fork |

128.10 | 137.40 | 9.30 | 8.14 |

| Incl. | 128.10 | 128.80 | 0.70 | 85.70 | |

| Also Incl. | 136.80 | 137.40 | 0.60 | 21.30 | |

| PG14-006 | Fork |

85.00 | 86.80 | 1.80 | 14.58 |

| Incl. | 85.00 | 86.00 | 1.00 | 22.50 | |

| PG14-011 | Fork |

152.50 | 156.00 | 3.50 | 17.18 |

| Incl. | 154.40 | 156.00 | 1.60 | 33.80 | |

| PG15-037 | Fork |

133.90 | 146.00 | 12.10 | 3.85 |

| Incl. | 133.90 | 135.50 | 1.60 | 8.54 | |

| Also Incl. | 143.50 | 144.50 | 1.00 | 8.89 | |

| RUM-07-21 | Fork |

209.00 | 211.00 | 2.00 | 7.51 |

| Incl. | 210.00 | 211.00 | 1.00 | 13.00 | |

| RUM-07-26 | Fork | 196.00 | 197.00 | 1.00 | 8.71 |

| RUM-07-38 | Fork | 243.00 | 244.00 | 1.00 | 12.04 |

| RUM-08-46 | Fork |

134.72 | 138.70 | 3.98 | 7.93 |

| Incl. | 137.10 | 138.70 | 1.60 | 18.48 | |

| RUM-08-49 | Fork |

107.65 | 120.70 | 13.05 | 13.97 |

| Incl. | 110.37 | 114.00 | 3.63 | 30.79 | |

| Also Incl. | 118.73 | 120.70 | 1.97 | 32.55 | |

| RUM-08-66 | Fork |

119.00 | 120.49 | 1.49 | 21.27 |

| Incl. | 119.75 | 120.00 | 0.25 | 125.19 | |

| RUM-08-68 | Fork |

95.70 | 97.00 | 1.30 | 50.48 |

| Incl. | 95.80 | 96.00 | 0.20 | 169.09 | |

| Also Incl. | 96.20 | 96.60 | 0.40 | 53.27 | |

| RUM-08-74 | Fork | 132.00 | 134.19 | 2.19 | 3.58 |

| RUM-08-75 | Fork |

190.45 | 195.38 | 4.93 | 3.84 |

| Incl. | 194.40 | 195.38 | 0.98 | 10.46 | |

| RUM-08-86 | Fork | 70.13 | 72.00 | 1.87 | 1.97 |

| RUM-09-98 | Fork | 226.78 | 228.44 | 1.66 | 5.75 |

*The “From-To” intervals in Table 1 are denoting overall downhole length of the intercept. True thickness has not been calculated for these intercepts but is expected to be ≥ 70% of downhole thickness based on intercept angles observed in the drill core. Internal dilution for composite intervals does not exceed 1m for samples grading <0.1 g/t Au.

TABLE 2: Drill collar summary for holes reported in this News Release.

| Hole ID | Target | Easting | Northing | Elev (m) | Length (m) | Azimuth | Dip |

| PDM04-311 | Fork | 434672 | 5645517 | 381 | 390.00 | 255 | -45 |

| PDM04-312 | Fork | 434672 | 5645517 | 381 | 275.00 | 259 | -49 |

| PDM04-313 | Fork | 434663 | 5645539 | 381 | 245.00 | 267 | -50 |

| PDM04-315 | Fork | 434663 | 5645539 | 381 | 312.00 | 258 | -55 |

| PDM04-318 | Fork | 434614 | 5645510 | 382 | 239.00 | 262 | -44 |

| PG14-006 | Fork | 434530 | 5645625 | 384 | 306.00 | 92 | -76 |

| PG14-011 | Fork | 434580 | 5645445 | 379 | 363.00 | 241 | -49 |

| PG15-037 | Fork | 434378 | 5645399 | 380 | 225.00 | 105 | -48 |

| RUM-07-21 | Fork | 434675 | 5645524 | 380 | 679.88 | 270 | -50 |

| RUM-07-26 | Fork | 434651 | 5645459 | 378 | 494.90 | 274 | -50 |

| RUM-07-38 | Fork | 434676 | 5645399 | 377 | 432.00 | 270 | -50 |

| RUM-08-46 | Fork | 434623 | 5645592 | 382 | 388.26 | 268 | -59 |

| RUM-08-49 | Fork | 434645 | 5645639 | 378 | 405.00 | 265 | -58 |

| RUM-08-66 | Fork | 434594 | 5645559 | 385 | 231.00 | 270 | -65 |

| RUM-08-68 | Fork | 434578 | 5645442 | 378 | 264.00 | 280 | -45 |

| RUM-08-74 | Fork | 434578 | 5645442 | 378 | 219.83 | 245 | -58 |

| RUM-08-75 | Fork | 434586 | 5645269 | 380 | 276.00 | 310 | -45 |

| RUM-08-86 | Fork | 434584 | 5645585 | 381 | 240.00 | 270 | -45 |

| RUM-09-98 | Fork | 434582 | 5645253 | 380 | 375.00 | 300 | -52 |

DISCUSSION:

The Fork deposit lies within two concordant shear zones spaced 100-150 m apart. These structures strike north-north-easterly and dip about -60°. The upper lens is known as the Main Zone and occurs along a shear zone that is continuous to the southwest with the shear zone that hosts the DV and CK Zones. The distribution of gold within this shear zone is controlled by the intersection with the contacts of minor ultramafic sills and iron formation units within the basalt.

The lower lens has been referred to as the Fork Footwall Zone (and it occurs within the Russet Lake Shear Zone (Baker, 2017). Here the Russet Lake Shear Zone is wholly within ultramafic volcanic rocks of the Russet Lake Ultramafic and gold mineralization is interpreted to be associated with the intersection of the shear with internal flow contacts. Significantly, the Fork Footwall Zone occurs within the same structural/stratigraphic position as the 8 Zone which occurs about 1.8 km down plunge to the northeast.

A third resource domain (North-South Domain) has been modeled between the Fork Footwall Zone and Fork Main Zone. It is not clear geologically how this relates to the modeled structures but may be a short second-order splay.

The Fork deposit is cut by late, discordant felsic, intermediate, and mafic dikes as in the mine. The mineralized body is curvilinear and is weakly folded by steeply southeast plunging F2 folds. Gold is predominantly associated with deformed quartz veins hosted within an envelope of highly strained and hydrothermally altered rock controlled by shear zones that developed oblique to the host volcanic stratigraphy. Less commonly, gold is found in replacement-style disseminations within altered basalt along and proximal to contacts with interflow iron formation or ultramafic sills. Geochemically, altered rocks at the Fork deposit are sodium-depleted as at the Madsen deposit. The Fork deposit has been drill tested over a 600 m strike length and to a vertical extent of 375 m depth. The mineralized zones are typically 1 m to 5 m thick. The deposit is located approximately 350 m from existing underground development in the West Ramp.

The Fork Footwall target is the sparsely drilled southwestern extension of the Fork Footwall Zone that particularly targets the intersection of the host Russet Lake Shear Zone structure with the Russet Lake ultramafic and overlying Balmer basalt contact. This 300 m long target has been tested by 11 drill holes and remains an active target.

FIGURE 2. Fork Vein Long Section Showing High-Grade Historic Intercepts from Drilling Completed Between 2004 and 2017. Existing underground development at Madsen shown along right margin of the figure approximately 250 m from the Fork resource.

QUALITY ASSURANCE/QUALITY CONTROL

The Madsen Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated resource of 1.65 million ounces (“Moz”) of gold grading 7.4 g/t Au within 6.9 Mt, and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au within 1.8 Mt. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Mineral resources as stated are inclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The Madsen Mine also contains Probable reserves of 478 thousand ounces (“koz”) of gold grading 8.16 g/t Au within 1.87 Mt. Mineral reserve estimates are based on a gold price of US$1,680/oz. Please refer to the technical report entitled “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025 (the “Madsen Report”). The Madsen Resource Estimate has an effective date of December 31, 2021, and excludes depletion of mining activity during the period from January 1, 2022, to the mine closure on October 24, 2022, as it has been deemed immaterial and not relevant for the purpose of the Madsen Report. A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world's richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines - Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gwen Preston

Vice President Communications

Tel: (604) 609-6132

Email: investors@wrlgold.com or visit the Company’s website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate”, “expect”, “estimate”, “forecast”, “planned”, and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release and include without limitation, statements relating to the results of the drill program at Madsen and the potential production of mining operations at the Madsen Mine; any untapped growth potential in the Madsen deposit or Rowan deposit; and the Company’s future objectives and plans. Readers are cautioned not to place undue reliance on forward-looking information.

Forward-looking information involves numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company’s securities; fluctuations in commodity prices; and changes in the Company’s business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis for the year ended December 31, 2024, and the Company’s annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

_____________________________

1 See Technical report entitled “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025, available on the Company’s website and on SEDAR+ at www.sedarplus.ca. The 1.5 million ounce indicated resource only considers the Austin, South Austin, and McVeigh zones at Madsen.

Figures accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/dc4c2c9d-adb4-41cf-9f9a-02c95a02f6b7

https://www.globenewswire.com/NewsRoom/AttachmentNg/635091fd-ccc9-4ca3-9070-45c35877b27a

https://www.globenewswire.com/NewsRoom/AttachmentNg/e3c53bc5-474d-4ecf-8614-56f6df356198

FIGURE 1. Conceptual Fork deposit mine design, shown relative to the Madsen Mine and past-producing Starratt-Olson Mine (above) and close up (below), with access driven from Level 3 of the McVeigh area of the Madsen Mine.

FIGURE 1. Conceptual Fork deposit mine design, shown relative to the Madsen Mine and past-producing Starratt-Olson Mine (above) and close up (below), with access driven from Level 3 of the McVeigh area of the Madsen Mine. Note these are provided to illustrate the proximity of the Fork deposit to the Madsen Mine and the initial mine design concept; Fork is not part of the Madsen Mine Pre-Feasibility Study (“PFS”) and mining at Fork has not been proven economic according to a Preliminary Economic Assessment, PFS, or Feasibility Study.

FIGURE 2. Fork Vein Long Section Showing High-Grade Historic Intercepts from Drilling Completed Between 2004 and 2017.

FIGURE 2. Fork Vein Long Section Showing High-Grade Historic Intercepts from Drilling Completed Between 2004 and 2017. Existing underground development at Madsen shown along right margin of the figure approximately 250 m from the Fork resource.

Madsen and Rowan Projects Location Map

Madsen and Rowan Projects Location Map

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.